Bitcoin's Role at Coinbase

Bitcoin is a Tier-1 protocol at Coinbase, reflecting its foundational importance to our strategy and the broader crypto economy. Our approach to supporting the network is focusing on three key pillars: its Core Protocol (L1), its function as a premier Asset (BTC), and its potential as an Innovation Layer.

This report details the key initiatives we've launched to execute on this strategy, organized into two main areas that support these pillars.

First, we explore how we are Building the Future of Finance with Bitcoin. These efforts, which support our "Asset" and "Innovation Layer" pillars, leverage Bitcoin as a foundational asset for new products. This suite of offerings includes cbBTC, and Bitcoin-backed loans. Beyond advanced DeFi products, we are also bringing Bitcoin into everyday spending - the Coinbase Card, which is designed to unlock new uses and broaden adoption.

Second, we detail our Protocol-Level Enhancements. This work supports our "Core Protocol (L1)" pillar and is designed to make Bitcoin more efficient, reliable, and scalable. These enhancements include our new, mempool-aware fee estimation service and our support for the Lightning Network.

Building the Future of Finance with Bitcoin

Building on these core protocol enhancements, Coinbase is leveraging Bitcoin as a new tool for financial products. These offerings are designed to connect the crypto economy with everyday finance, creating real value for our users.

cbBTC: Unlocking Bitcoin's DeFi Potential

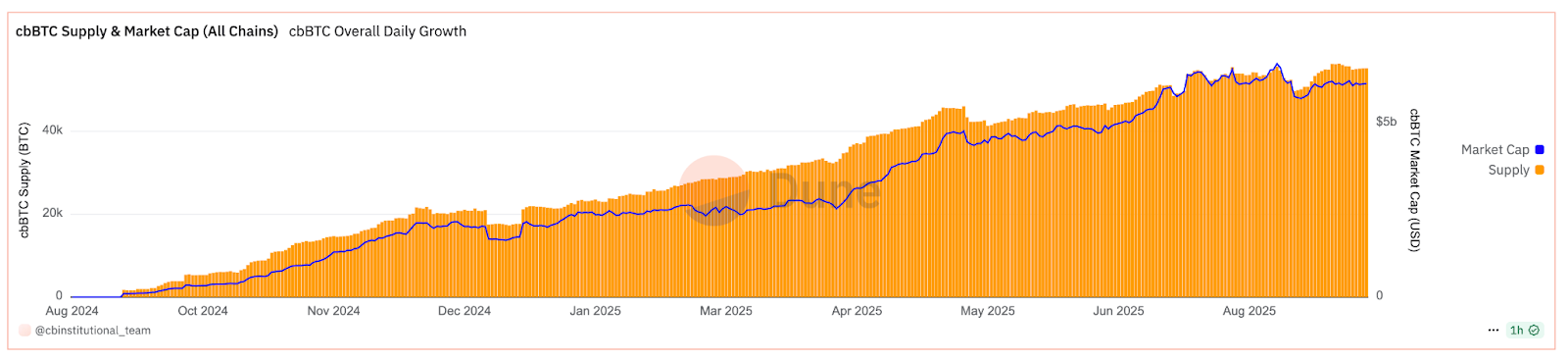

Coinbase Wrapped BTC (cbBTC) is our solution for bringing Bitcoin's deep liquidity into the decentralized finance (DeFi) ecosystem. By making Bitcoin compatible with applications on Base, Ethereum, Arbitrum and Solana, cbBTC unlocks its potential as a productive asset. Since launching in late 2024, adoption has grown consistently. The total supply now exceeds 68,000 BTC with a market capitalization of over $8.2 billion1 as of October 2025. This growth is further evidenced by a rapidly expanding user base, with the number of daily cbBTC holders surpassing 516,000 across multiple chains.

The supply and market capitalization of cbBTC have shown consistent growth since its inception*.

*Past performance is not a reliable indicator of future results.

Bitcoin-Backed Lending: A New Paradigm for Liquidity

Our onchain Bitcoin-backed loans product on Coinbase allows users to unlock the value of their Bitcoin without the need to sell. By collateralizing their cbBTC, customers can borrow USDC directly onchain via the Morpho protocol on Base, providing instant liquidity while retaining their long-term investment. This streamlined process requires no credit checks or lengthy applications, offering a capital-efficient way to access funds. The product has seen significant traction, with onchain borrow originations surging to over $1B2 by October 2025. This strong market demand validates our strategy of building an integrated financial ecosystem where a user's Bitcoin can serve as productive collateral.

The volume of onchain borrow originations has grown significantly, highlighting the demand for Bitcoin-backed loans.

The Coinbase One Card: Earning Bitcoin on Every Purchase

The Coinbase One Card seamlessly integrates Bitcoin into the daily financial lives of our users. Offered exclusively to Coinbase One members, the card provides an industry-leading 4% back in Bitcoin on all purchases. With no annual fees and the ability to spend directly from a Coinbase cash balance, this premium reward structure transforms everyday spending into a powerful tool for accumulating Bitcoin. This creates a positive cycle of earning, spending, and saving within our ecosystem, reinforcing the value of our membership and driving the utility of crypto in everyday life.

Protocol-Level Enhancements

Coinbase is committed to improving Bitcoin's core capability at our services, focusing on initiatives that enhance its utility, scalability, and day-to-day efficiency. These efforts are crucial for making Bitcoin a more practical and reliable medium for payments by directly addressing key challenges like network congestion and transaction costs.

Intelligent Fee Estimation: Optimizing Transfers

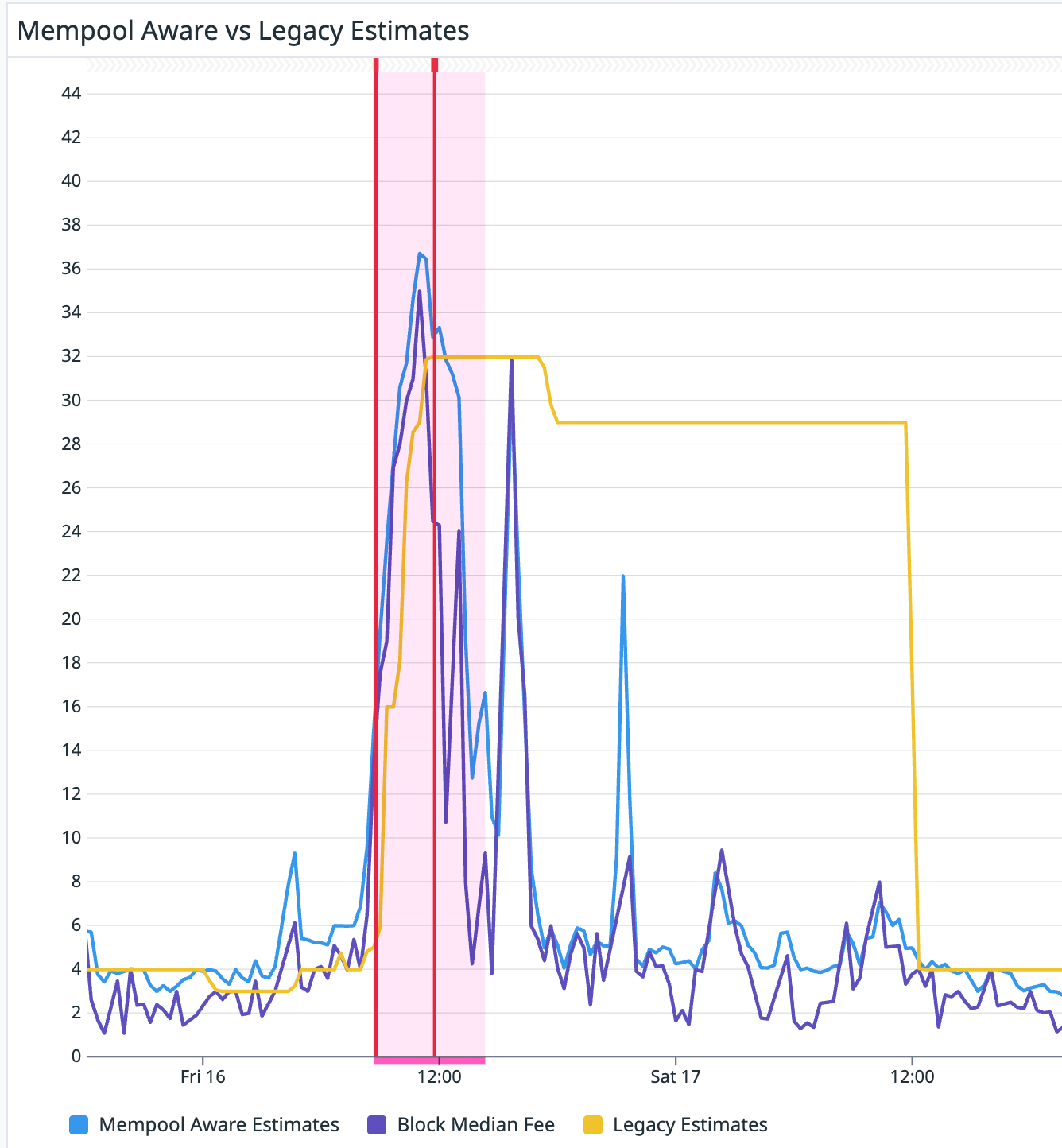

To navigate the complexities of Bitcoin's dynamic fee market, Coinbase has deployed an advanced, mempool-aware fee estimation service. This system analyzes real-time, mempool data to provide more accurate and reliable fee predictions than legacy methods. This enhancement directly benefits our retail customers by focusing on responsiveness. It ensures they pay the minimum fee possible while dramatically improving reliability, boosting our next-block transaction landing rate from 75% to 99%. This system also delivers substantial cost savings by avoiding persistent high estimates after congestion. Internal analysis shows the new service has prevented an estimated $9 million in potential overpayments over the last twelve months and is saving an additional $1 million annually on Custody transfers alone. The chart shows that the mempool-aware fee estimation rapidly reacts to both spikes and relaxations in congestion.

Mempool-aware fee estimation rapidly reacts to both spikes and relaxations in congestion.

Lightning Network: Scaling Bitcoin for Payments

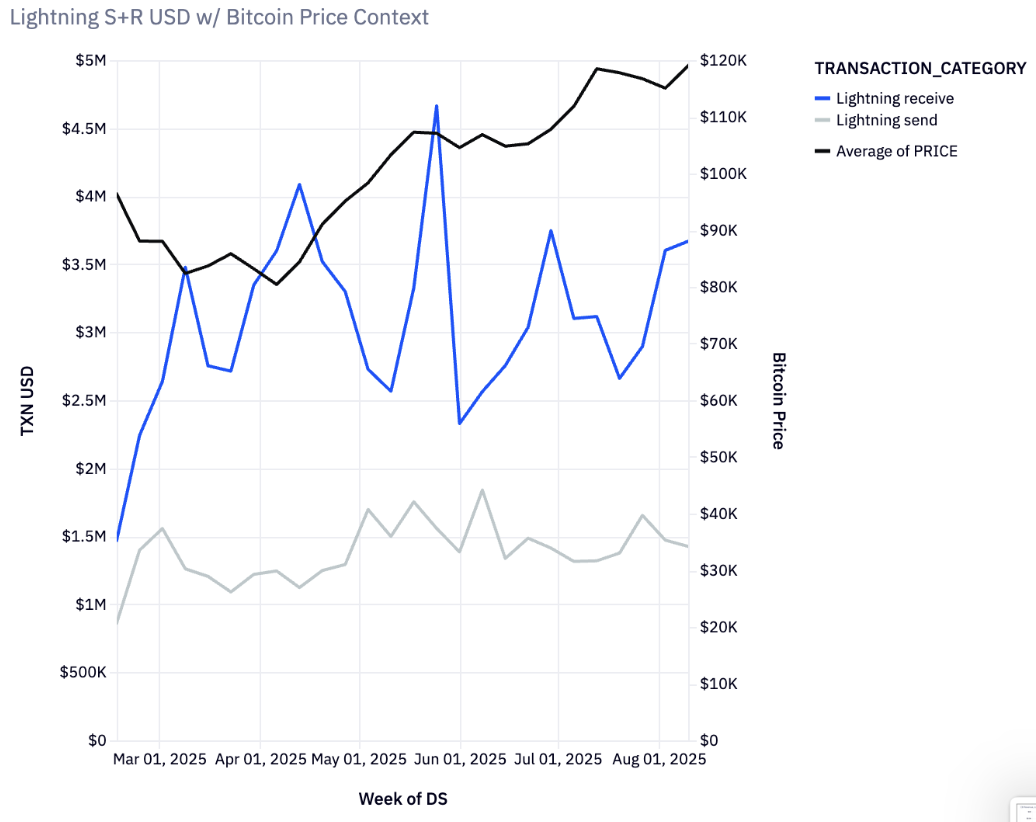

To address the need for faster and more affordable Bitcoin transactions, Coinbase has integrated the Lightning Network for our retail users. This Layer 2 solution provides an efficient, near-instant alternative to onchain transactions, reducing transfer costs by over 80%. This translates to an estimated annual savings for our users of between $2.6 million and $21.7 million, depending on network congestion and the price of Bitcoin. This level of weekly activity, reaching approximately 26,000 receives and 18,000 sends, confirms that the Lightning Network remains a vital component of our strategy to make Bitcoin a practical medium for payments.

Lightning Network transaction counts on Coinbase for sends and receives.

Looking Ahead

Bitcoin stands as a foundational pillar of the crypto economy at Coinbase. The initiatives detailed in this report are not isolated improvements; they represent a comprehensive execution of our three-pillar strategy.

We remain committed to leading this charge, building the infrastructure, and delivering the products that will unlock Bitcoin's full potential for generations to come.

1 cbBTC: https://dune.com/cbinstitutional_team/cbbtc

2Coinbase Onchain Borrow: https://dune.com/ryanyyi/coinbase-onchain-loans

Disclosures

Information is provided for informational purposes only and is not investment advice. This is not a recommendation to buy or sell a particular digital asset or to employ a particular investment strategy.

Coinbase USDC Rewards is a customer loyalty program offered at Coinbase’s discretion. USDC reward-bearing products are not savings accounts. USDC Rewards are not deposits and are not insured by the FDIC or SIPC.

Coinbase One Card is offered through Coinbase, Inc. and Cardless, Inc. Cards issued by First Electronic Bank. American Express is a registered trademark of American Express and is used by the issuer pursuant to a license.

The Coinbase One Card is subject to credit approval and other eligibility requirements. An active, paid Coinbase One membership is required to open and maintain a Coinbase One Card account and to earn bitcoin back (also referred to as “bitcoin rewards”). For Coinbase One Basic, an annual plan is required. If your membership becomes inactive or is canceled, your Coinbase One Card account may be closed.

Only Coinbase One Card cardholders are eligible to earn bitcoin back. Bitcoin back rates are tiered at 2.0%, 2.5%, 3.0%, and 4.0%, based on your Assets on Coinbase (AOC) at the time an Eligible Purchase is initiated. Bitcoin back at the 2.5%, 3.0%, and 4.0% rewards tiers are capped at a combined $10,000 in Eligible Purchases per calendar month (then 2.0% thereafter for such calendar month). For the first 60 days after your Coinbase One Card account opening, AOC is based on your real-time balance at the time of your Eligible Purchase. After that, AOC is calculated as the average of your daily end-of-day balance over the past 30 days.

Not all transactions are eligible to earn bitcoin rewards (e.g., cash advances, cash equivalents, gambling). Bitcoin rewards are provided by Coinbase and may fluctuate in value. If a purchase is reversed, refunded, or canceled, the original value of any bitcoin rewards earned will be charged back to your Coinbase One Card account. Terms, conditions, and limitations apply. See the Coinbase One Card Rewards Program Terms & Conditions for full details.

A Coinbase One subscription renews automatically and requires recurring payments. Membership benefits vary by region and may be changed or removed without notice. Boosted USDC rewards & boosted staking rewards: Rates subject to change. Zero trading fees: Coinbase Advanced excluded; Coinbase includes a spread in the price when you buy, sell, or convert cryptocurrencies.

Certain exclusions, restrictions, and limitations apply. Please refer to the Terms and Conditions for full details.