Institutional-grade crypto financing solutions

Deploy advanced trading strategies with fully-integrated portfolio margin, instant leverage and shorting. Earn passive income with agency lending and access customizable financing solutions for institutional needs.

Sign up for crypto insights delivered straight to your inbox

Deploy institutional-grade trading strategies

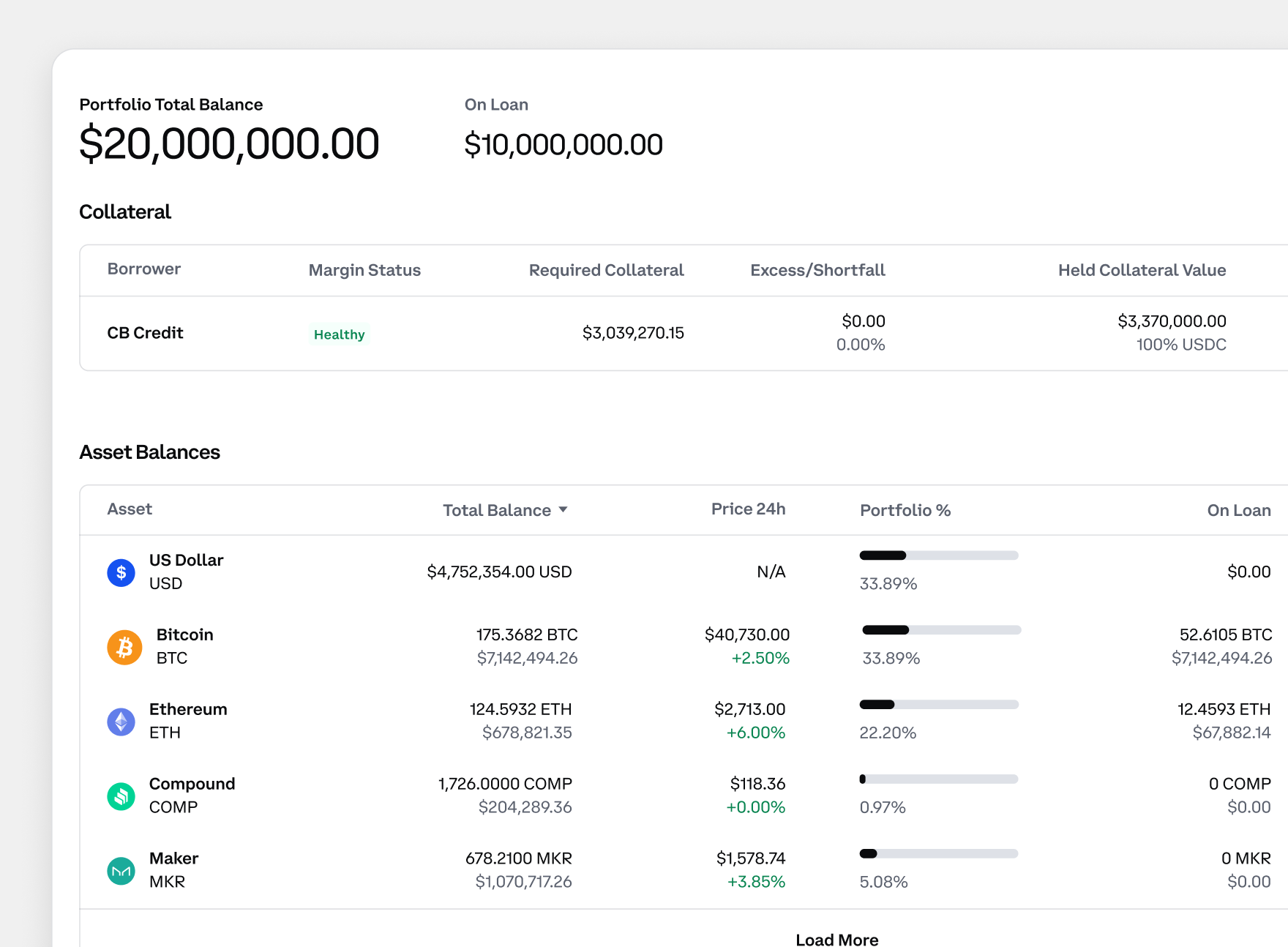

Leverage portfolio holdings

Flexible financing solutions provide capital-efficient access to leverage, shorting, and yield, from a single integrated platform

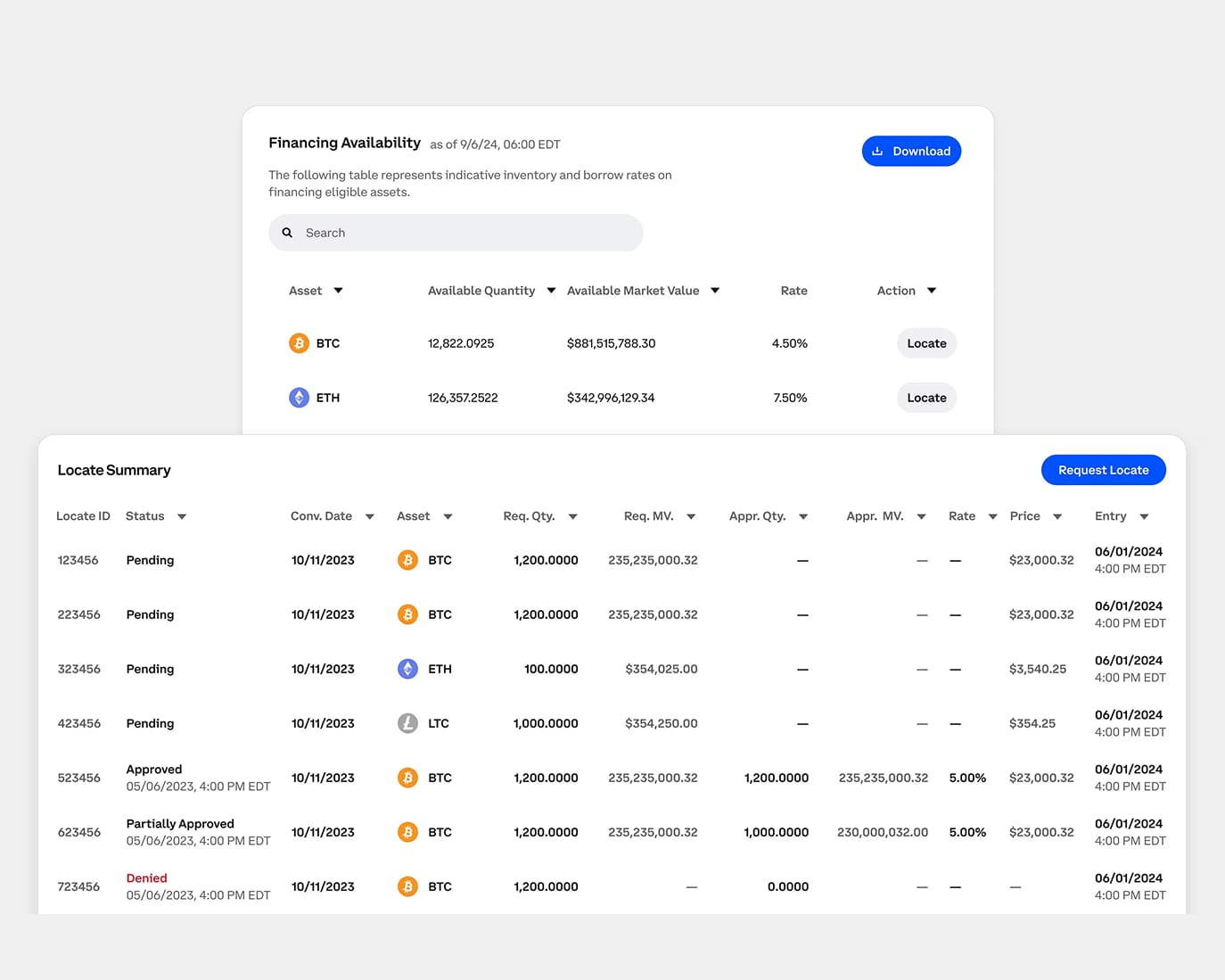

Superior short inventory

Diverse sources of supply provide broad, deep, and stable availability of digital assets for shorting

Market-leading liquidity

Able to facilitate the largest and most sophisticated customer transactions

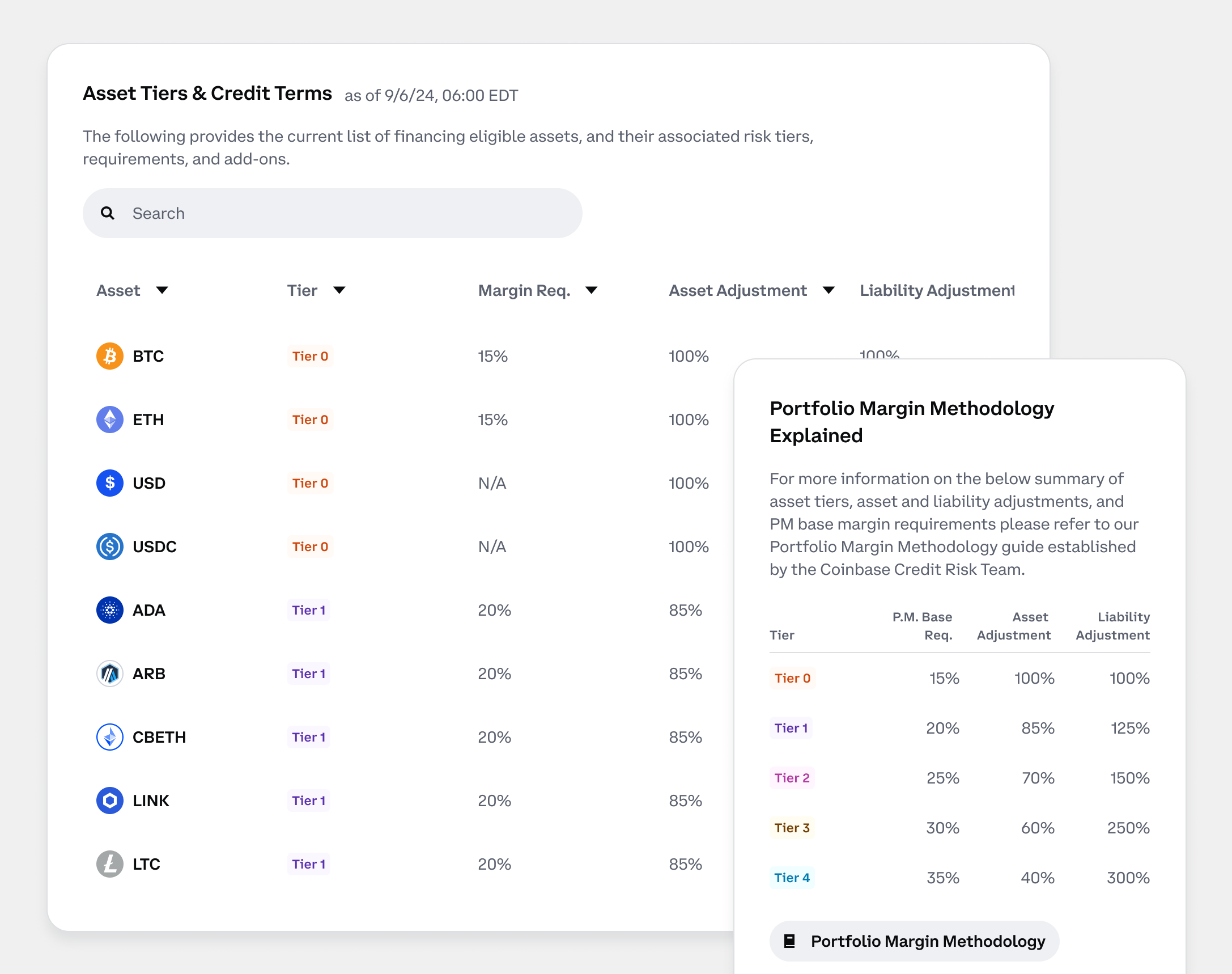

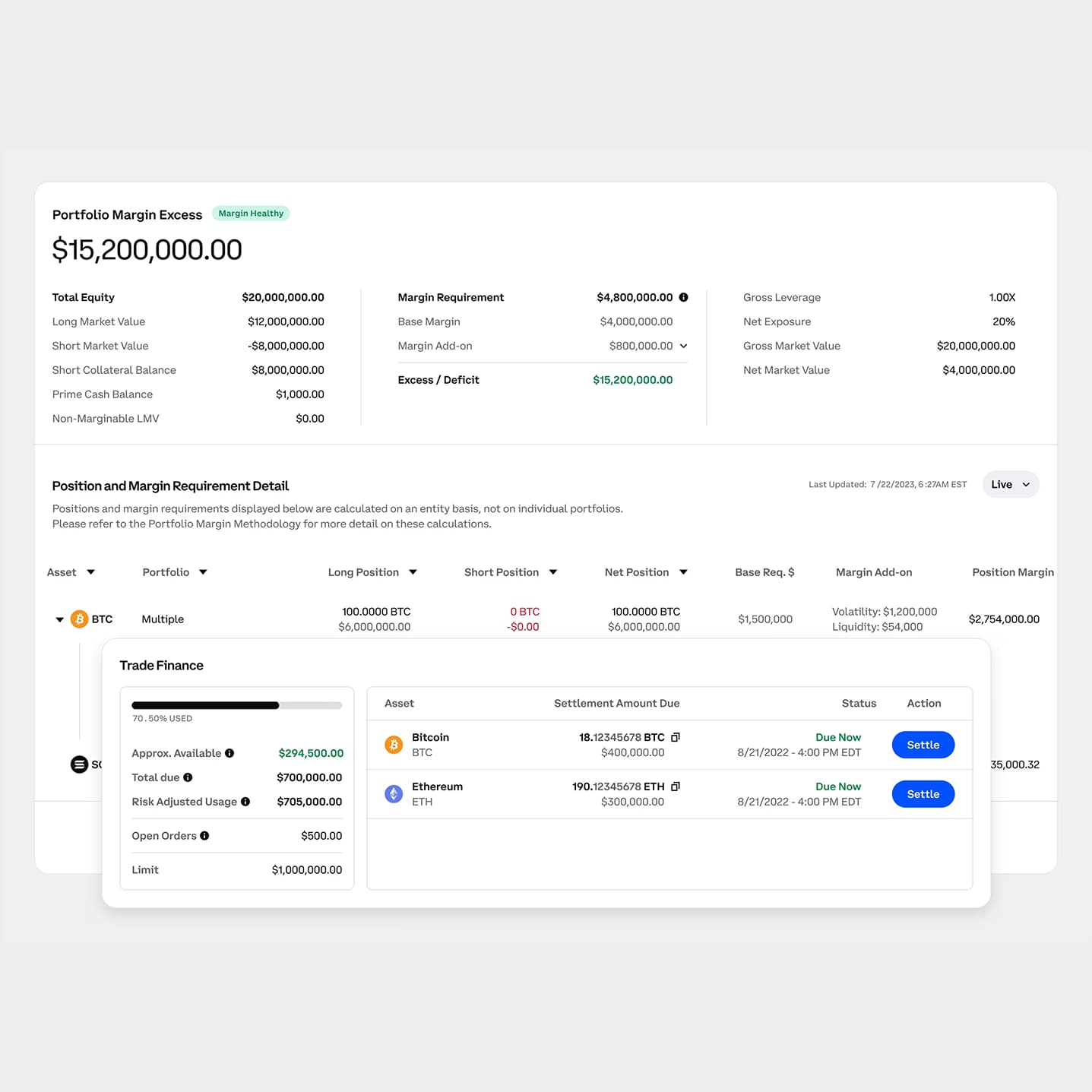

Transparent and persistent margin requirements

Sophisticated and programmable risk models consider overall portfolio composition, as well as accounting for asset volatility and liquidity

Access digital asset financing you can trust

Experienced in risk management

Our teams have many decades of experience in managing risk, across assets and through market cycles

Attuned to the market

Our sophisticated modeling captures market outlier events, and is refined through regular evaluation and stress testing

Designed to minimize operational risk

Risk management is a first principle in our product design, and we provide unprecedented transparency to our clients

Fully integrated capabilities

Optimized portfolio management

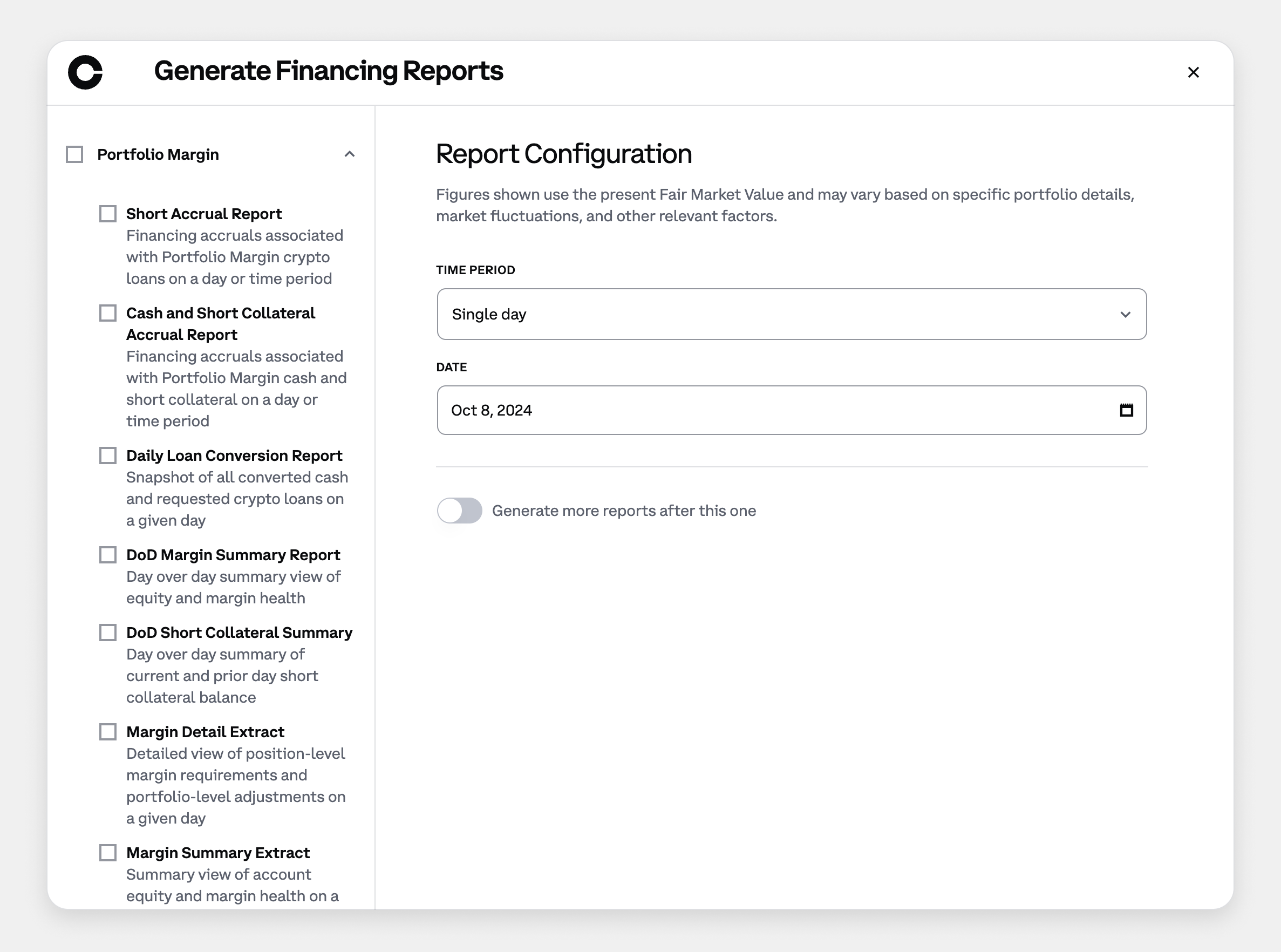

Market access, execution, reporting, margin and position management, as well as custody and staking — all seamlessly integrated in the Prime platform

Enabling a wide range of investment strategies

Deploy advanced trading strategies with the power of the Prime platform APIs and differentiated financing capabilities like availability files and locates

Proven track record

Delivering comprehensive and innovative prime services to some of the world's leading institutional investors since 2021

Unlock the value of your portfolio

Earn Passive Income

Generate passive income on digital assets in a low-touch framework professionally managed by the Coinbase Agency Lending team

Trusted Agent with Unmatched Market Reach

Coinbase acts as a fully-outsourced lending agent, leveraging our proprietary technology and deep relationships to provide market-leading risk adjusted returns to asset owners

Over-Collateralized Lending & Competitive Liquidity

Battle-tested collateral requirements and margin processes protect client assets – plus, fast loan recalls provides for easy liquidity

Transparent and Efficient Operations

Our dedicated team leverages custom-built trading systems and operational processes; daily reporting provides full transparency at all times

Take the next step in institutional crypto.

Disclaimer: This material is the property of Coinbase, Inc., its parent, and its affiliates and is for informational purposes. This material is not accounting, investment, legal, or tax advice. Please note that all investments involve risk, including risk of loss, and thus may not be suitable for everyone. Recipients should consult their advisors before making any investment decision. Trading venues not connected to Coinbase Prime may offer better pricing. Coinbase, Inc. is licensed to engage in virtual currency business activity by the New York State Department of Financial Services and is not licensed with the U.S. Securities and Exchange Commission or the U.S. Commodity Futures Trading Commission.

View our licensing information here.

Coinbase Custody Trust Company, LLC is chartered as a limited purpose trust company by the New York State Department of Financial Services to engage in virtual currency business.

Copyright 2025 | Coinbase, Inc.